Peace of mind for foreign guests - Switzerland and the Schengen area

Eta-Glob's Visitor Insurance - protects guests from abroad

Eta-Glob's Visitor Insurance for Schengen is a low-cost travel insurance for foreign visitors to Switzerland. It is valid in all countries of the Schengen area but your destination must be Switzerland. This guest insurance offers basic protection against medical treatment costs hospital, doctor and repatriation.

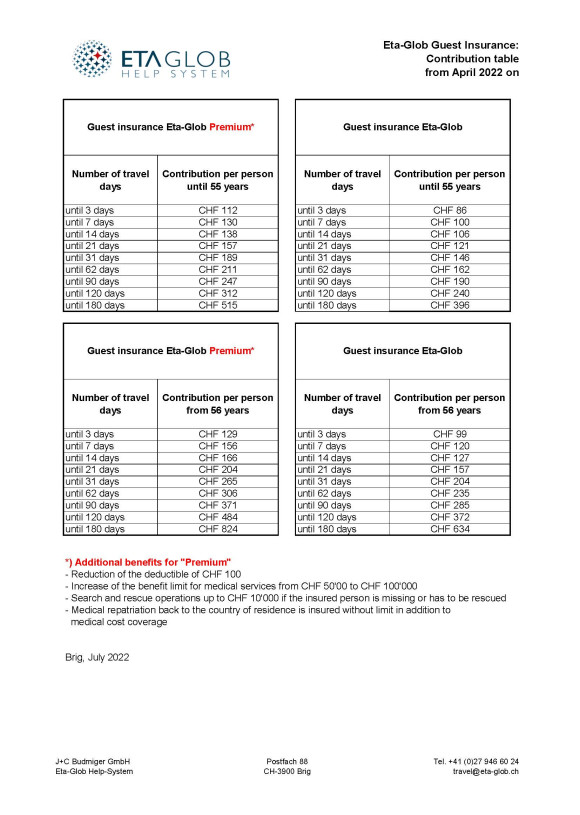

Benefits and prices of Eta-Glob's Visitor Insurance

Maximum age of insured person

People that are between 0 and 79 on the day of insurance start can be insured.

Insurable travel duration

1 to 180 days

Travel insurance for Schengen visa

Our Eta-Glob's Visitor Insurance is suitable if you need to present an insurance contract to obtain a Schengen visa.

Eta-Glob's Visitor Insurance meets all requirements of Regulation (EC) No. 810/2009 of the European Parliament and the Council of the European Union of 13.07.2009 for a Schengen visa and is recognized by embassies, consulates and immigration authorities.

How quickly will I receive the insurance certificate?

You will receive all the documents by e-mail no later than four days after your online registration and payment of the insurance premium.

Last possible insurance conclusion

The insurance must be taken out at the latest on the 5th day after entry into Switzerland.

If you have already been in Switzerland or the Schengen area for longer than 5 days, you will need a different insurance, which we will be happy to offer you. Please contact us.

Benefits

Eta-Glob's Visitor Insurance (budget version) covers up to CHF 50,000 for:

-

Outpatient treatment and hospitalization (doctor and hospital)

-

Rescue and transport costs to the nearest suitable hospital

-

Repatriation and funeral costs

-

Organization and reimbursement of medical repatriation to a hospital suitable for treatment in the country of residence

-

Deductible per event: CHF 200

Additional benefits in the PREMIUM version:

-

Deductible per event only CHF 100 instead of CHF 200

-

Increase of medical cost coverage to CHF 100,000

-

Search and rescue costs up to CHF 10,000

-

Unlimited cover for medical repatriation to the country of residence

Languages

The brochures, insurance conditions and policies are available in German and English.

The Emergency Center is stationed in Switzerland and ensures round-the-clock assistance in German, French, Italian and English.

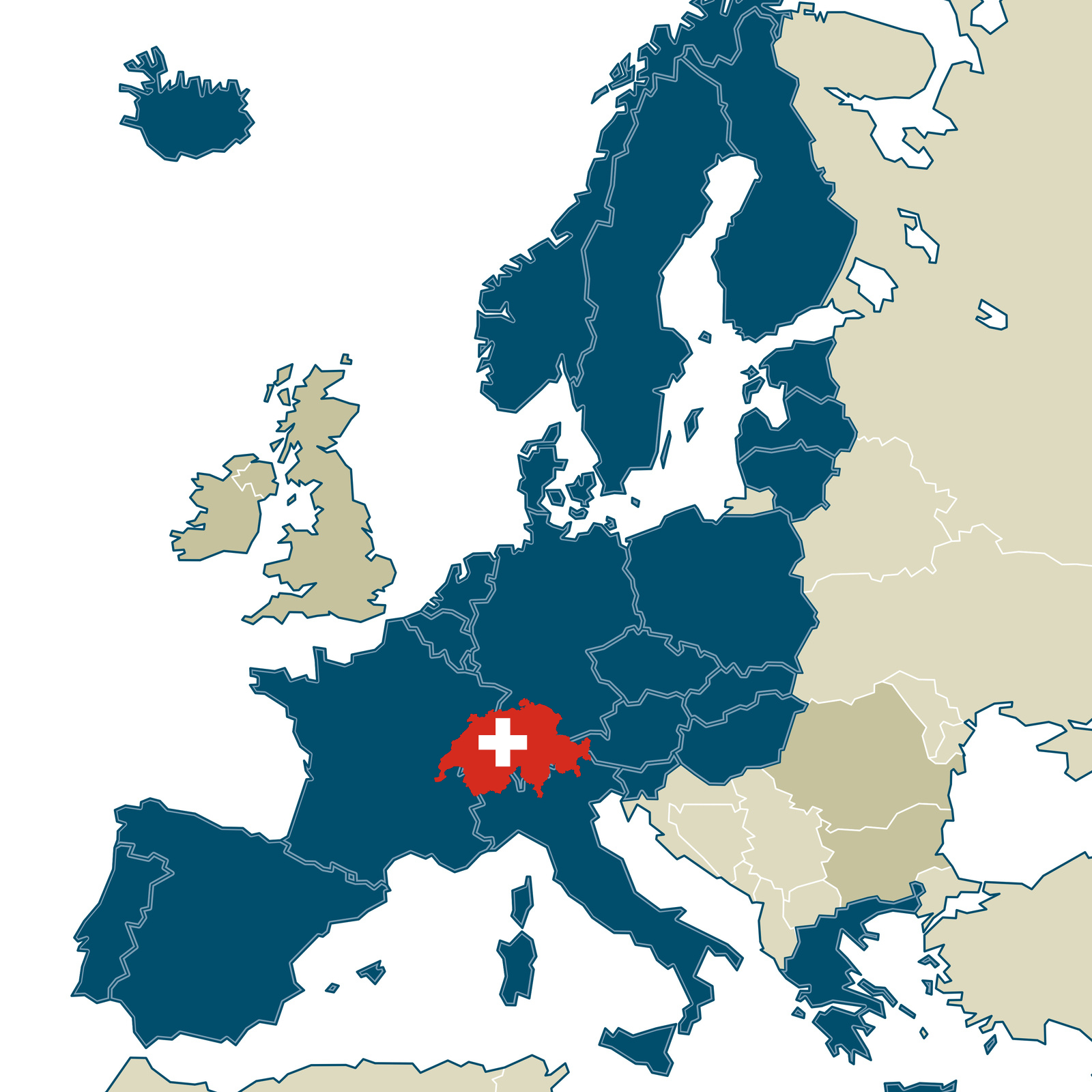

Geographic validity

The insurance applies only to events in the following states of the Schengen area:

- Austria

- Belgium

- Czech republic

- Denmark

- Estonia

- Finland

- France

- Germany

- Greece

- Hungary

- Iceland

- Italy

- Latvia

- Liechtenstein

- Lithuania

- Luxembourg

- Malta

- Netherlands

- Norway

- Poland

- Portugal

- Slovakia

- Slovenia

- Spain

- Sweden

- Switzerland

There is no insurance cover in the current country of residence of the insured person, even if this should be in the Schengen area.

Insured trip duration

1 to max. 180 days

Escape clause

For claims and the exact benefits, only the original conditions of the insurance company are authoritative, in no case the information provided on this website .

Downloads

Why did we develop the Eta-Glob's Visitor Insurance?

Insurance based on your needs

Our years of experience helped us to develop the Eta-Glob Visitor Insurance based on the needs of our customers.

Market requirements

On the one hand, regulations require that guests from abroad have a travel insurance policy that meets certain minimum requirements in order to obtain a Schengen visa.

On the other hand, many visitors look for an insurance that properly covers them against treatment costs after an accident or in case of illness. Health care costs are very high in many Schengen countries, especially in Switzerland - and for this reason you want to avoid this cost risk.

Swiss insurance law

Swiss consulates and embassies recommend choosing an insurance company that is subject to Swiss or Liechtenstein legislation.

Our insurance partner, HanseMerkur International in Vaduz (FL), meets these requirements.

Since 1996 there is a common insurance market between Switzerland and the Principality of Liechtenstein, thus HanseMerkur from Vaduz is automatically authorized as a direct insurer for Switzerland.